Client story How a Global Finance Company Saved £3.9 Million when renewing its Microsoft Enterprise Agreement

By Insight UK / 17 Sep 2020

A multinational banking and financial services company was looking for ways to avoid overpaying tax when renewing its Microsoft Enterprise Agreement.

It chose to work with Insight as a Licensing Solutions Partner (LSP). As well as having the expertise, Insight has a big enough global footprint to provide local billing – enabling it to mitigate the risk of Withholding Tax and Double Taxation. Thanks to Insight’s License Consulting Service, the company was able to realise £3.9 million in savings over the contract term.

The Challenge

A UK-based multinational finance company needed to mitigate the costs of cross charging when renewing its Microsoft Enterprise Agreement.

Cross-charging between entities based in different countries can lead to Withholding Tax and Double Taxation – where income from the product or service being charged for is taxed twice – unless there is an agreement in place between the two countries involved.

The company needed to identify where agreements for reduction of Withholding Tax existed between one country and another. It also needed to find a supplier with a large enough global footprint to provide local billing, to mitigate the situation.

The Solution

Insight’s solution focused on reducing the cost of cross charging from a Withholding Tax and Double Taxation perspective.

Insight worked with its partner, Cloud Optics, to identify agreements to reduce or eliminate Withholding Tax between one country and another. For example, by invoicing from Insight Austria to the customer’s entity in Egypt, Insight eliminated the need to pay Withholding Tax due to the tax treaty that exists between the two countries.

Insight’s billing optimisation solution was possible thanks to its global footprint, which includes Hong Kong, the United Kingdom, USA, Norway, Austria, France, Singapore and more.

By looking at all available opportunities and creating an invoicing ‘matrix’ for the Microsoft Enterprise License Agreement renewal, Insight presented significant cost savings to the Bank.

The Benefits

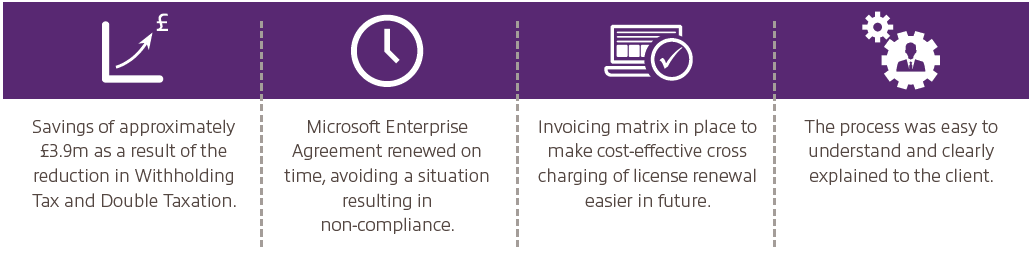

- Realised savings of approximately £3.9m thanks to Insight’s solution.

- The Microsoft Enterprise Agreement was renewed by the deadline, avoiding noncompliance charges.

- The invoicing matrix made future license renewals more straightforward.

- Solution was clearly presented and easy-tounderstand.

- Insight’s expertise and smooth management of the project ensured the client was not burdened with the complex and time-consuming process of aligning each entity.

The Results Highlights

Quick Overview

Client:

A multinational finance company

Size:

Globally, 232,000 employees

Challenge:

Mitigate the costs from Withholding Tax and Double Taxation when renewing Microsoft Enterprise License

Insight Solution:

License Consulting Service

The client is a British multinational banking and financial services holding company. One of the world’s largest banks, it owns over £2.5 trillion in assets and has 232,000 employees.